jefferson parish property tax sale

To 430 pm Monday through Friday. Assessed Value 20000.

Jefferson Parish Assessor S Office Property Search

This auction includes 57 properties located throughout Jefferson Parish including properties in Metairie Jefferson.

. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2022 assessments will be updated on the website. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill. The Judicial Sales Office hours are 800 am to 430 pm Monday through Friday.

Ad Buy Tax Delinquent Homes and Save Up to 50. Yearly median tax in Jefferson Parish. Payments are processed immediately but may not be reflected for up to 5 business days.

Its duties also include organizing and directing annual tax sales. The preliminary roll is subject to change. Property tax bills may be remitted via mail hand-delivery or paid online at our website.

Parish Attorneys Office Code Collections 1221 Elmwood Park Blvd Suite 701 Jefferson LA 70123 Fax. They are a valuable tool for the real estate industry offering both. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

In an effort to recover lost tax revenue tax delinquent propertys located in Jefferson Louisiana are sold at the Jefferson Parish tax sale. Generally the minimum bid at an Jefferson Parish Tax Deeds Hybrid sale is the amount of back taxes owed as well as any and all costs associated with selling the property. You may call or visit at one of our locations listed below.

Please contact the Jefferson Parish Sheriff 504-363-5710 for payment options. Online Property Tax System. Box 9 Gretna LA 70054 Fax.

Government Building 200 Derbigny 4th Floor Suite 4200 Gretna LA 70053 Phone. 043 of home value. In Building D of the Westbank Administration Complex at.

This page will open in a new window and this window will stay open so you may return to it for your convenience. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 Gretna and is open to the public from 830 am. Property Tax Calculation Sample.

The link below will take you to the Jefferson Parish Sheriffs office Forms and Tables page of their Web site. State St in Jennings at 10 am. Drop Box checks only Jefferson Parish Sheriffs Office 3300 Metairie Road 1st Floor Metairie LA 70001 Only open from December 1 2021 - January 31 2022.

Tax delinquent propertys are sold to winning bidders state laws differ though often they are sold for the amount of unpaid taxes typically a fraction of the full market value. Taxed Value 12500. The Tax Sale is held at the Jefferson Davis Parish Courthouse located at 300 N.

Suite 1200 Gretna LA 70053. Sales Use Tax Registration Form. The New Orleans Advocate contains the Judicial Advertisements and legal notices that the Sheriff of Jefferson Parish is required to publish under LA.

Louisiana is ranked 1929th of the 3143 counties in the United States in order of. Jefferson Parish Government Building 200 Derbigny St. Millage Rate for this example we use the 2018 millage rate for Ward 82 the Metairie area x11340.

Due to the Annual Tax Sale this site can only be used to view andor order a tax research certificate. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

Search For Title Tax Pre-Foreclosure Info Today. Click Here to view the latest Judicial Advertisement as published in The New Orleans Advocate. For Properties Located on the Westbank.

Homestead Exemption Deduction if applicable-7500. Adjudicated Property Auction to be Held Online on August 15 August 19 2020. Successful purchasers at the Jefferson Parish Louisiana tax deed.

Groceries are exempt from the Jefferson Parish and Louisiana state. Payment Guidelines for Judicial Sales click here REVISED MARCH 2021. Yes - Nearly 100 real estate property accounts are sold each year for delinquent taxes.

On the scheduled date. Parish Attorneys Office Code Collections 200 Derbigny St. A convenience fee of 249 is assessed for credit card payments.

The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made within Jefferson Parish. Market Value 200000. 200 Derbigny St Suite 1100 Gretna LA 70053.

The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax. Affidavit to Partially Release Mortgage Inscriptions Pursuant to Property Tax Sale Title Examination. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more.

The sale of Louisiana Tax Deeds Hybrid are final and winning bidders are conveyed either a Tax Deed or a Sheriffs Deed. You can find the SalesUse Tax Registration form there. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Assessed value is the Taxed value if no Homestead Exemption is in place. Can you tell me a little about the Tax Sale. As per LA RS 472153 all unsettled property taxes are read aloud to the.

They are maintained by various government offices in Jefferson Parish Louisiana State and at the Federal level. The sales are held each Wednesday at 10 am. GGB Suite 5200 PO.

Register for 1 to See All Listings Online. Ad Be Your Own Property Detective. Detailed listings of foreclosures short sales auction homes land bank properties.

Jefferson Parish Needs Your Help If you or anyone you know is interested in becoming an Election Commissioner please have them contact our office 504-736-6394 or attend one of the following training classes. Our office is open for business from 830 am. Utilize our e-services to pay by e-check or credit card Visa MasterCard or Discover.

Property Maintenance Zoning Quality of Life. Does anyone really fail to pay his or her taxes. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

The JPSO is tasked with the responsibility of seizing property that is in default and holding judicial auctions and sales on behalf of the creditor. Get In-Depth Property Tax Data In Minutes. Start Your Homeowner Search Today.

However according to state law Tax Deeds Hybrid purchased at an Jefferson.

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Reconstruction Grant Kickoff Meeting

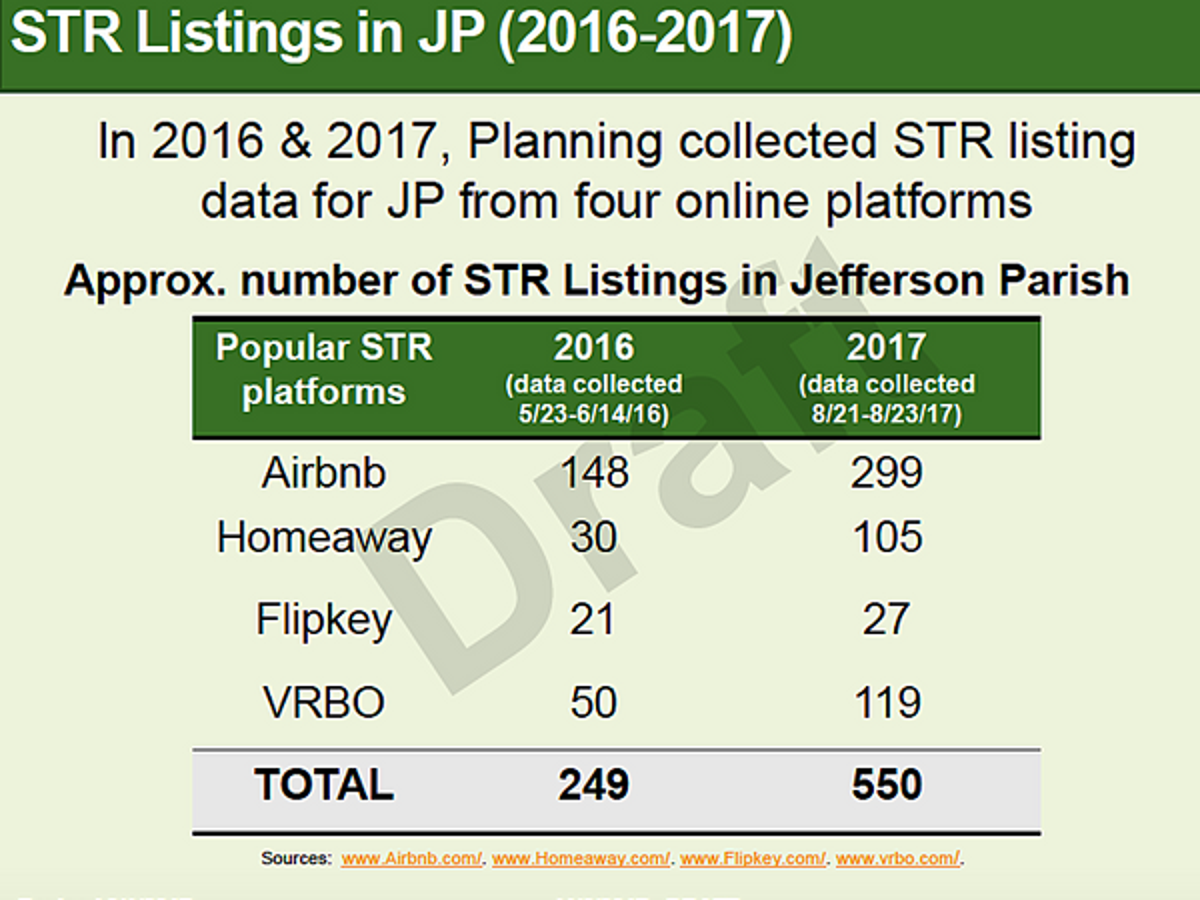

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

What Jp Residents Need To Know To Pay Property Tax

Charles Washington Hall Charles Town Wv Charles Town West Virginia Towns

Payments Jefferson Parish Sheriff La Official Website

Hurricane News And Information